“The smallest effort matters and makes a difference.”

-Danielle Steel, A Gift of Hope

Hello, friend!

Welcome to Journey to Millions!

In my previous article about making more money, you watched how Elvin (my ex-boyfriend, now husband) struggled to help send his brother and sister to college while saving up for our dream wedding. Propelled by his burning passion to tie the knot, he took a leap of faith and used his creativity to maximize his earning potential; something that many of us can also do to augment one’s limited income.

It was a great success for Elvin, having his financial goals met, you might guess. But as anyone would agree, the road to millions is not without its own challenges, especially when the journey is shared by two in marriage.

In this article, you will discover our Top 10 Biggest Personal Finance Mistakes that we hope you would avoid.

As we share our Top 10 Biggest Personal Finance Mistakes, we highly recommend that you reflect on your own experiences and ideas, with the intention to improve your very own financial life.

Personal Finance Mistake No. 10: Not investing as early as college

We’ve read and heard this countless of times, “START EARLY,” but we actually didn’t. We learned about some investing principles at the age of 24 but didn’t take it seriously until a year after we finally settled down. Back then, we invested very small amounts every month because we really didn’t know how much was enough to invest. We didn’t even have a ball park number for our retirement goals. Looking back, we regret not investing as early as we can, as much as we could have invested. How we wish we had known personal finance way back in high school or college! If we had only known what we now know earlier in life, we could have properly saved and invested much more.

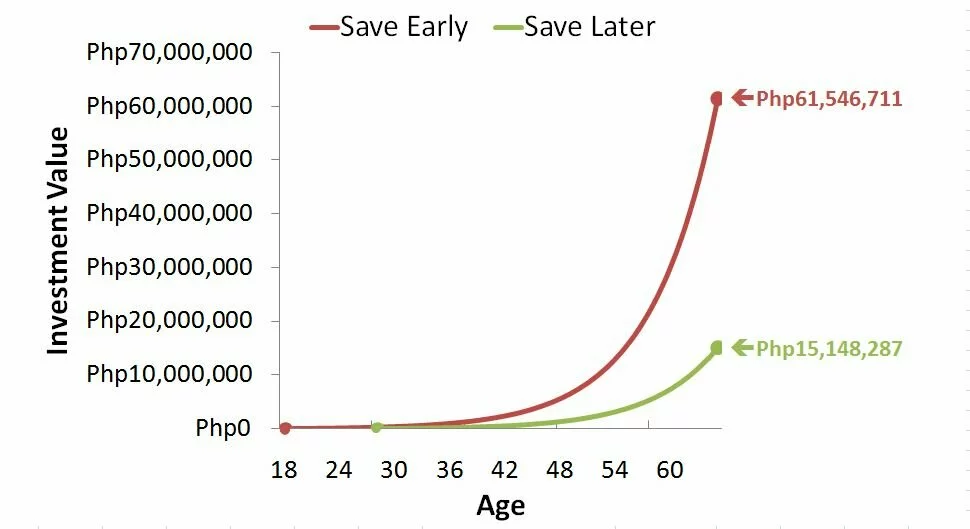

To help you visualize how much money we lost for not investing as soon as we can, here is a simple illustration:

The graph demonstrates the growth of both investor’s wealth over time and highlights the benefits of saving early. The red line started investing Php 1,000 per month at age 18 on 15% interest while the green line started investing the same amount and same interest rate at age 28.

Personal Finance Mistake No. 9: Not having a detailed spending plan

We’ve always wanted to make sure that we live below our means. So, when we finally got together in a house, we made sure to reserve a certain portion of our income for our essential expenses or things that we cannot live without. However, we failed to set detailed spending limits for the things that we needed. There were many times when we ended up spending way more than what we were supposed to, and that’s because we failed to put the much needed details in our spending plan. For example, we intended to spend only 15% of our income for food and toiletries, but we didn’t itemize what food and toiletries we need and how often we need them.

There have been a lot of times when we needed to add more money into our food and toiletries budget because we ran out of shampoo, conditioner, toothpaste, and soap in the middle of the month, all at the same time. We didn’t have a choice but to reallocate some of our funds again, or else, we wouldn’t be able to take a bath for the whole second half of the month. Eeew.

Personal Finance Mistake No. 8: Not tracking our expenses

This question haunted us for a very long time, “Where did our money go?” And this is the same question that an expense tracker is able to answer objectively. We didn’t need to point fingers at each other. We need not second guess where we over spent or saved. By simply looking back at our good old records, we know right away where we chose to direct our hard-earned money or not. Tracking our monthly expenses allowed us to look back and reflect on our financial decisions. We get to check whether our spending habits reflect our financial priorities. From the feedback we get from our expense tracker, we then move to making the necessary adjustments. Literally, this is Kaizen at work.

Personal Finance Mistake No. 7: Buying a 3-in-1 financial product (life insurance, health insurance, and investment bundled in one product) AND defaulting on it

We were young and naive, knowing nothing much about financial products. Upon taking the advice of product-linked financial advisors, we ended up buying a 3-in-1 financial product that provided us with 2% of the ideal term life insurance for our age and minimal health insurance benefits at an exorbitant price. Initially, we thought that we were doing the right thing. But after our first year, we defaulted, and all the money we spent on it was gone forever.

Several years later, we learned from personal finance experts like Suze Orman and Dave Ramsey that the best life insurance we could ever buy is pure term life insurance, not those that are investment-linked. Pure term life insurance is far cheaper than any other insurance such as whole life insurance or variable universal life insurance. Because it’s cheaper, we can purchase a plan with the highest possible coverage, given our limited budget. But be sure to compare prices first before deciding to buy. If you are brave enough to ask for quotations from three or more life insurance providers before committing your money, you will surely save a lot of moolah in the long run.

Personal Finance Mistake No. 6: Purchasing too much data plan

Yes, we love the internet, and we feel like we can’t live without it. But subscribing for one data plan for Elvin’s phone, one data plan for my phone, one data plan for our iPad, and one data plan at home is obviously too much. BUT we didn’t realize this until about a year or so. Imagine how much money we were wasting! We were spending so much on our data plans that we had to limit our regular gimik with friends just to accommodate our monthly bills. We were so desperate to fix the issue but we couldn’t terminate our contracts right away. There was a 24 months lock-in period for each device, so we really had to wait it out or pay a hefty penalty for not finishing the contract. What a pain in the a*$!

Personal Finance Mistake No. 5: Asking someone else to adopt our data/mobile plans

Back then, we really wanted to get rid of our excess data/mobile plans, so we offered people to adopt them. We were very thrilled when we finally got two of them adopted. We thought that it was such a creative idea! However, after two or three months, we started to realize how dangerous our decision was. Yes, we had our data/mobile plans adopted BUT they are still under our name! So, if the adopters miss out on a monthly payment, we would be obliged to pay whatever amount they incurred, just to keep our records clean. There was this one time when one of them failed to pay for four months! We were so shocked and so worried, we couldn’t sleep peacefully at night. We promised that we wouldn’t be doing it ever again.

Personal Finance Mistake No. 4: Loaning money to a “friend”

We love helping people. We love reaching out when our friends are in need. So, when a childhood friend approached us for some money for the first time, we didn’t hesitate to help. We gave out money for free, without expecting anything in return. After several months, this friend of ours came back to ask for money again. This time, we agreed to lend some money, with the expectation to be paid back at a certain time without interest. However, we were never paid back, not even a single peso.

We didn’t hear from this person for some time, not until we got another text message where we were being asked to lend money for the third time. We were in shock! We wondered, “How could someone be so insensitive?” We haven’t been paid for the previous loan, and yet, we are being asked to lend some more. We decided to express our dismay politely and didn’t give in to the pressure. BUT after some more months, our “friend” came to visit us with her aunt. We thought that maybe they came to apologize and to patch things up. To our surprise, it turns out that she actually accompanied her aunt to borrow money from us too! Waaah! How crazy is that?

The craziest thing is, despite all the ill feelings their actions brought us, we still gave them some money and just simply told them that it would be the last. We hated what we did, and promised to never ever loan money to a “friend” again (unless we’re ready to let go of that money forever).

Personal Finance Mistake No. 3: Asking Edel to shop

I love to shop. When I shop, I take time to read labels, check prices, and compare products. Even if I had a list of the things I need to buy, I take time to roam around the supermarket or the mall to see items that are either new or on sale. As a result of these behaviors, I end up buying more than what is needed. Obviously, this was not a very good practice. Elvin, on the other hand, focuses on the items on the shopping list, zooms to the appropriate rack, and gets the items paid fast. Because of this, Elvin volunteered to take the task of shopping for us. We save a lot of money this way.

Personal Finance Mistake No. 2: Asking Elvin to budget

There was a time when we agreed to have Elvin manage our funds. He is such as generous husband that he hated saying “no” to any of my requests. Even if we didn’t have money anymore, he wouldn’t tell me that. If I requested for anything, he would gladly approve of it, even if it meant using his credit card. When we finally became aware of his weakness, we decided to have me manage our funds.

Gradually, I have become more conscious of whether we have money for a specific expense or not. If I need or want something, I wouldn’t have to request for it from my husband. I would simply need to check if we still have available funds for whatever that expense is. If we have enough money, we buy it. If not, we save for it, making us less susceptible to credit card debt. And of course, Elvin wouldn’t need to feel guilty if he couldn’t provide on the spot. As our family’s official fund manager, it’s my responsibility to make sure that everything is covered.

Personal Finance Mistake No. 1: Depriving oneself for the sake of investing more money

We only have one life; we ought to enjoy it. This simple but profound thought is what we forgot when we decided to use most of our “fun fund” for our investment. Back then, we still didn’t know how to compute for an ideal amount for our monthly savings and investment, so we committed the mistake of investing too much. We didn’t have money to go on gimiks with friends. It was horrible! We felt so unhappy. We are the type of couple who loves mingling with friends and family. So, when we unintentionally limited our freedom to go out and have fun with them, we felt sick, sad, and stuck. From then on, we adjusted and learned the art of balance.

We are as imperfect as everyone else. Yes, you and I.

All of these financial mistakes cost us significant amount of money, but we’re still lucky to realize them at this early stage of our lives. But it’s never too late for anyone to stop, think, and make a change. Our only limit is our very own creativity and imagination.

Now, let’s talk about YOU.

What personal finance mistakes have you had in the past? Or is currently committing at this time? What lessons do you get from these mistakes? Share them in the comments section below and start inspiring us with your own stories.

Also, as always, do you know someone who would benefit from knowing these personal finance mistakes? If yes, take a second and send them a link to this article. Help us help others become freer, happier, and more hopeful about money and life.

Enjoying our Journey To Millions,

Love,

Edel

If you enjoyed reading this article, get email updates (it’s free).

Image taken from Bankruptcy Law Network

Dimples is a Filipino Personal Finance Advocate, a work-at-home wife and a graduate of the University of the Philippines.

Dimples is a Filipino Personal Finance Advocate, a work-at-home wife and a graduate of the University of the Philippines.

Elvin is a loving husband, an MS Excel Guru and the one who enjoys lurking at the comment section to answer readers’ questions.

Elvin is a loving husband, an MS Excel Guru and the one who enjoys lurking at the comment section to answer readers’ questions.

{ 20 comments… read them below or add one }

My personal finance mistakes:

1. Not having a clear spending and saving plan.

2. Not investing regularly. I just put an initial fund and let it go.

3. Not having a financial goal. I just reacted to whatever came up.

Thank you so much for sharing your top 3 personal finance mistakes, Joshua. I hope you overcome them like we did. More power!

My personal finance mistakes were:

1. Not taking about finances with my wife before we got married.

2. Taking out too many student loans.

3. Waiting so long to start investing in myself.

Now I am on track and the sky is the limit. Oh and letting family/friends borrow money.

You can do it, Thomas! I hope you succeed in paying for your student loans soon and in investing to grow your money!

My money mistakes are:

* Letting people know I can NOW afford stuffs so I end up letting them borrow money from me. I have yet to received all there payback. ugh! 🙁 Now, I know much better.

*Buying stuffs to impress people.

* I, too, started investing in my mid 20’s, I wish I had known about investing earlier,I would have been home by now.

That said; No Shame, No Blame. 🙂

Hi, PINASforGOOD! Welcome to our Journey To Millions! 🙂

Tempting talaga mag-flaunt minsan, ano? I also experience the same challenge at times. I grew up in a family that loves to flaunt wealth (kahit wala naman masyado). And that attitude kicks in every now and then.

Good thing, my husband is a very simple man. I try to emulate him the best I could. The path to richness requires frugality, so I have no choice but to control my demons. 🙂

Great list!

I especially agree with no.7! I agree so much, I think it should be #1 hehe

But it’s great that you mentioned deprivation. People usually associate saving and responsibility with sacrifice. When in fact, just cutting out the frivolous usually makes a world of difference already.

Thanks for the comment Carlos. I agree with you that most people associate saving and investing with sacrifice which is not the case. It is really a matter of perspective. 🙂

One mistake that I did was not securing an emergency fund early on. I focused too much on investment and insurance. Before, I thought that insurance is enough to cover for the emergencies.

By the way, I was shocked at #4 (lending money to a friend). I’m very strict with money, so even if they’re my friend (or extended family), they have to tell me:

1. where they’ll use it.

2. how they plan to pay me back.

3. and when will they pay me back.

Example, if they’ll use it for their child’s tuition, I’ll issue a check instead of giving them cash. If they’ll buy something for whatever reason, I ask for the receipt. That way, the money will be going where it’s supposed to be. Plus, I’ll be protected from liars.

Also, no second utang if the first one is not paid back yet. And as long as they keep their word, I will continue to help them.

What if they don’t pay? I let it go. My mom would call it “ilista mo na lang sa tubig”. At least in my heart, I know I was able to help. But like I said, no more second utang.

Hi Carlo,

Thank you for dropping by.

I also had that tendency to put everything in the stock market when I learned how money works. It’s really tempting. Back then, I thought investing in the stock market is enough not until Edel got hospitalized while the stock market is down. Good thing, we have an emergency fund.

Edel and I were surprised on how you deal with “utang”. Giving them check instead of cash and asking for receipt, for me, is a smart thing to do. We’ll also do that. Thanks for the advice.

Sa oras na ito ay talagang meron akong financial problems. Nangutang akong minsan sa bombay para sa maliit kong tindahan. Nang hindi ako regular na nakakahulog araw-araw sa bombay napilitan akong umutang ulit sa isang lending company dito sa amin. Sa gusto kong makabayad sa mga utang ko ay nangungutang ako sa iba. Namalayan ko na lang na lubog na pala ako sa utang. Ngayon di ko na alam ang gagawin ko kung paano ako makakabayad or makakaahon sa utang. Please help me. Thank you so much.

Hi Ely,

Thank you for sharing your financial problem.

Habang binabasa ko po ang comment nyo ay naiimagine ko na sobrang nagigipit talaga kayo sa mga pang-araw-araw na gastusin. Hindi nagiging sapat ang kinikita para masustentuhan ang araw-araw na pangangailangan. Eto po ang dahilan kung bakit kayo hindi nakakabayad sa inyong mga utang.

Isa lang po ang masasabi ko (nawa po ay makatulong), hindi po porke’t gipit kayo ngayon ay magiging gipit na kayo habang buhay. Kailangan lang po talaga ng disiplina at kagustuhang makabawi sa pagkakalubog. Kung wala po kasi ang kagustuhang makabawi at disiplina, mahihirapan na po talagang makabawi.

Pwede nyo pong basahin ang mga nauna naming blog posts para sa mga steps na inyong sundin para makaahon.

Eto po yung mga link:

1. Setting Financial Goals

2. Knowing Your Net Worth

3. Create Outcome and Process Goals

4. Create a Spending Plan

5. Make More Money

Sana po ay makatulong.

Thanks so much Elvin. Medyo nakakaluwag ng kalooban ang mga pieces of advice mo. Good luck. Ingat.

Hi Edel,

I am about to purchase a life insurance from Sunlife Canada (phil).

Can you suggest a pure term life insurance they offer? I was initially interested in the investment-linked part of the Variable Universal Life Insurance but leaning on not deciding to do that instead I would do the investing with COL Financial. May I know which pure term life insurance you have?

Thank you

Julee

Hi Julee,

Edel already replied to you via email. 🙂 Just let me know if you haven’t receive it.

Personal Finance Mistake in the past: NOT SAVING FOR AN EMERGENCY FUND

We thought having a life insurance is good enough to secure our family’s future. And as my husband’s income increases and kids growing, we also upgraded our life insurance portfolio. However, fear of the future keeps on haunting us.

In 2010, we learned about saving and investing. From then on, we have planned and built our emergency funds and other funds for short and long term.

Good day po! Ako po ay isang GSIS member, and merun pong mga insurance company na nag aalok sa akin, at medyu po na co-convince ako bumili ng products nila. Guzto ko lang po malaman opinyon mo kung sapat na ba yung GSIS membership ko. Marami pong salamat

Hi, Eden!

To be honest, mahirap pong magbigay ng opinyon kung sapat or hindi sapat ang GSIS ng hindi nakikita ang buong financial picture nyo. Kailangan po nating malaman kung magkano ang gastos nyo at ang makukuhang benepisyo sa GSIS. Saka lang po natin malalaman kung yun ay sapat na.

I’m assuming po na gagamitin nyo ang retirement benefit ng GSIS, tama po ba? If that’s the case, tingin ko po hindi po dapat insurance company ang kausap nyo. Baka po dapat ang kausap nyo ay investment company.

ask kpo where is better to hv insurance? sunlife?or BPI philam Life?pls email me po

Hi, Nicol!

Both of these companies have great products. It really depend on your needs.

{ 1 trackback }