What are the benefits of banking with a credit union?

Personalized Customer Service

One of the most significant benefits of banking with a credit union is the personalized customer service. Credit unions are often smaller than traditional banks, which means they can offer a more attentive and customized approach to their customers. They are also member-owned, so their primary goal is to serve the needs of their members rather than maximizing profits for shareholders. This focus on member satisfaction often results in friendlier, more responsive service, making banking with a credit union a more enjoyable experience.

In addition, credit unions typically have fewer customers than banks, which means that each member can receive more personalized attention. This can make solving any issues or concerns much easier and more efficient, as you're more likely to speak with someone who knows and understands your individual needs and circumstances.

Lower Fees and Better Rates

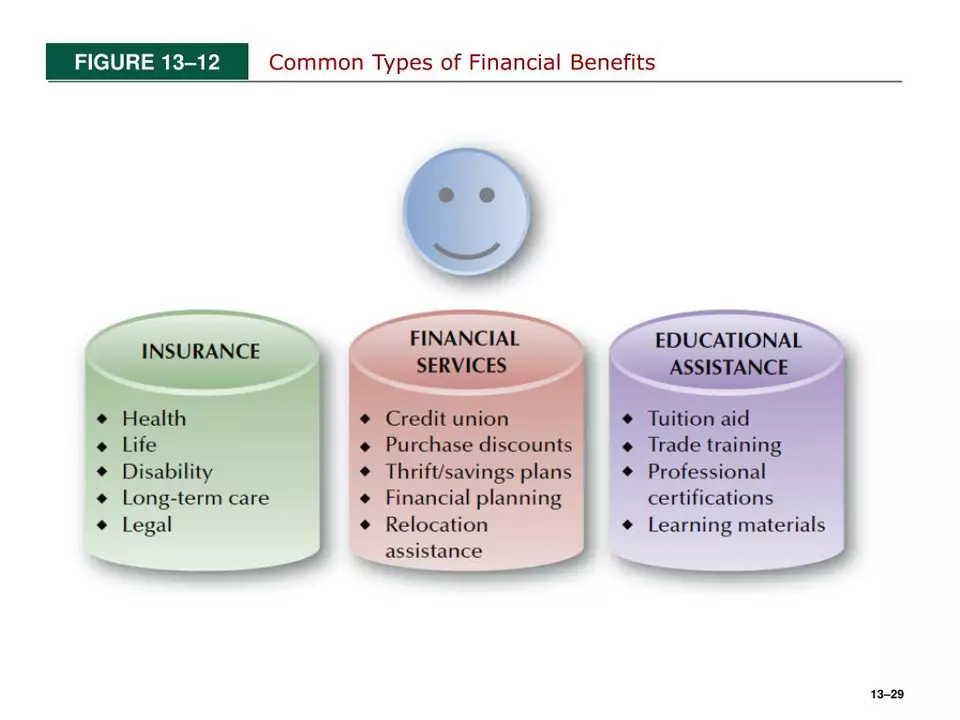

Another advantage of banking with a credit union is that they generally offer lower fees and better rates on financial products compared to traditional banks. Since credit unions are not-for-profit organizations, their main focus is on providing affordable financial services to their members. This means that they can offer lower fees on things like checking accounts, ATM transactions, and overdraft services.

Additionally, credit unions often provide higher interest rates on savings accounts and certificates of deposit, making it easier for you to grow your money. They also tend to offer lower interest rates on loans and credit cards, which can save you a significant amount of money over time. Overall, banking with a credit union can be a more cost-effective option when it comes to managing your finances.

Community Focus

Banking with a credit union can also benefit you by supporting your local community. Credit unions are typically focused on serving the specific needs of the communities in which they operate. This means that they are more likely to invest in local businesses and offer financial products and services tailored to the unique needs of the community members.

In addition, credit unions often give back to the community through charitable donations, sponsorships, and volunteering. By banking with a credit union, you can feel good knowing that your money is helping to strengthen and support your local community.

Financial Education and Resources

Credit unions often prioritize financial education and resources for their members. Since their main goal is to help members achieve financial success, they are more likely to provide resources like financial workshops, online education tools, and one-on-one financial counseling. These resources can help you better understand your finances and make more informed decisions about your money.

In addition to educational resources, credit unions may also offer other financial tools and services that can help you achieve your financial goals, such as budgeting tools, financial planning services, and credit counseling. By taking advantage of these resources, you can improve your financial knowledge and make the most of your banking experience.

Flexible Lending Options

When it comes to borrowing money, credit unions can offer more flexible lending options than traditional banks. Since they are member-owned and community-focused, they can be more understanding of individual circumstances and are often willing to work with members who may not qualify for loans at traditional banks. This flexibility can be a lifesaver for those who need a loan but don't have perfect credit or a high income.

In addition, credit unions often offer a wide range of loan products, from personal loans to mortgages and auto loans. This means that you can find a lending solution that fits your specific needs and goals.

Shared Branching and ATM Networks

One common misconception about credit unions is that they have limited access to ATMs and branches. However, many credit unions participate in shared branching and ATM networks, which allow members to access their accounts at thousands of locations nationwide. This means that you can enjoy the convenience of banking with a larger institution while still benefiting from the personalized service and better rates offered by a credit union.

These networks also typically have lower or no fees for using ATMs or branches of other participating credit unions, making it even more cost-effective to bank with a credit union.

Democratic Control

As a member of a credit union, you have the opportunity to participate in the democratic control of the institution. Credit unions are member-owned, which means that each member has an equal say in the decision-making process. This includes voting for the board of directors and having a voice in important matters that affect the credit union's operations and direction.

This democratic control helps ensure that credit unions remain focused on the needs and priorities of their members, rather than the profits of shareholders. It also gives you the chance to actively shape the future of your financial institution and make sure it aligns with your values and goals.

Eligibility for Membership Rewards

Many credit unions offer membership rewards and perks to their members. These rewards can include things like cash back, discounts on loans, and lower fees on specific services. By banking with a credit union, you may be eligible for these rewards and can take advantage of the additional benefits that come with being a member.

In addition to financial rewards, credit unions may also offer other perks like access to exclusive events, workshops, and networking opportunities. These benefits can help enrich your overall banking experience and make it even more rewarding to be a credit union member.

Hello, my name is Theodore Kingswell and I am an expert in the field of education. With a background in teaching and educational research, I have dedicated my life to improving the quality of education for students of all ages. I am passionate about sharing my insights and experiences through my writing, as well as collaborating with others to create innovative solutions for the challenges facing education today. In my free time, I enjoy cycling, reading educational journals, and nature photography, alongside attending conferences and workshops to stay up-to-date on the latest trends and developments in the world of education.